Looking at the past to predict the future

Lessons We Can Learn From the COVID-19 Pandemic

Amid the unprecedented time of COVID-19, a recession is imminent, and the preparation for the economic damage this global pandemic will cause must begin. Looking back on history, conclusions can be made on what is to come and lessons can be learned on how to better combat its effects.

Demand for Mediation Services Will Rise

We should expect the demand for mediation services to come in waves, now and for many months. The first wave, family stresses from the response to the health crisis, is already here. The closing of schools and businesses, layoffs and stay-at-home orders combined with the uncertainty and fear of the coronavirus itself is putting enormous strain on families. There are already reports of increased demand for family mediation as a result, and press reports from China cite a surge in divorce proceedings in regions where the government strictly enforced stay-at-home regulations. Not only have these specific pressures increased, but the courts are also closed, leading judges to refer family, parenting and other civil issues to mediation. Mediators seem to have been more adept than courts in adopting remote mediation technology to meet the needs of their clients via video conference while maintaining social distancing. By most reports, the adoption of the new technology by mediators has gone much better than might have been expected and many mediators are fully engaged in trying to keep up with current demand.

The second wave will be commercial disputes arising from the devastating financial impact of the pandemic. There have been massive layoffs and large portions of the service economy from travel and tourism to the local barber shop have been essentially stopped cold. Claims for unemployment benefits surpassed historic highs. Despite differences in the cause of the current recession and the government’s response, looking back to the 2009 recession may be a good guide to what we should anticipate in this second wave.

What We Can Learn From the 2009 Recession

The 2009 recession was driven by the collapse of years of misguided real estate transactions, so it follows that there was an increase in demand for mediation of mortgage foreclosures and landlord-tenant disputes. Many state court systems established special programs to mediate these cases. With predictions of unemployment rates exceeding those of the Great Depression in the 1930’s we should anticipate the need for those programs to be reinstated as we strive to emerge from the financial fallout of the pandemic.

The 2009 recession also appears to have increased the rates of general business and commercial disputes worldwide. In a survey conducted by the global corporate law firm Norton, Rose, Fulbright, 64 percent of those surveyed agreed with the statement, “Economic downturns tend to increase litigation volume.” While corporate efforts to cut costs during hard times may lead to increased exploration of mediation or other alternatives to litigation, it is important to note that increases of litigation may not translate proportionally into demand for mediation. If money is tight, in some cases it may seem prudent for a defendant to pay smaller monthly litigation costs in an effort to push payment of a substantial judgment to better times. Still, it is reasonable to expect that demand for mediation in connection with insolvencies, breach of contract, debtor-creditor, investment advice and services, employment compensation and tax matters will increase as the financial impact of the pandemic settles in.

Although the requirements of social distancing, stay-at-home or shelter-in-place orders may be straining marriages and family relationships now, the evidence of the impact of purely financial stress on the potential demand for mediation services is mixed. Although the harmful impact on a marriage of financial distress is well researched, partners simply may not be able to follow through with divorce plans in a poor economy. Costs of living separately, existing debt, lack of equity in a home value and even the cost of paying for mediation can compel couples to ride out hard times. Also, when government budgets were squeezed during the 2009 recession, a significant number of courts terminated mediation programs, and community-based mediation programs also lost funding. As the second wave replaces the first, we may see a softening from the current peak in demand for family mediation services.

Role of Mediation Services Is Crucial During Economic Recovery

Mediation services have and will continue to prove crucial in economic recovery. They play a critical role due to the impossibility of consumer and business confidence when claims, disputes and business relationships are unsettled.

How Mediation Will Help

Confidence: the word that encapsulates the requirements of recovering from a recession. In order to do so, consumers must be confident enough in their future ability to go back to buying goods and services. That means they have been able to pursue job opportunities and are now confident about employment, their personal debt is under control, and they have stable housing situations. Businesses need stable supplier relationships, workable arrangements with creditors and access to additional capital, and confidence in current and future customer demand for their product or services. While confidence in both consumers and businesses is essential to economic recovery, the resolution of disputes with business partners and family matters are essential ingredients in achieving this confidence. Mediators should play a critical role in reaching the business and interpersonal resolutions. Mediation is faster, less expensive and more likely to lead to a stable outcome than the alternatives.

Recommendations for Mediators

Perhaps the most important lesson to be learned by looking back at the most recent recession is that recovery might have benefitted from greater support of mediation services. We can see the success local mortgage foreclosure mediation programs had in clearing the backlog of those disputes as examples. This freed homeowners from burdens and helped them take the next step, whether that was focusing on their local job or selling the house and pursuing a new one. In contrast, there may have been material mistakes made in the elimination of funding for other court and community mediation programs. By eliminating those resources, we likely prolonged the resolution of claims and disputes, delaying the return of financial and personal stability and confidence needed to pull an economy out of recession.

It will be understandably difficult to focus on the future given the daily flow of dire new information and the need to rapidly refocus on how to provide mediation services in the current environment. Nevertheless, it is not too early to get federal, state and local officials involved in the delivery of judicial services in our country to plan for the predictable surge. The more the professionals of dispute resolution can continue to serve their clients now and throughout the economic wake of the pandemic, the sooner we can foresee a return to better times.

How We Can Help

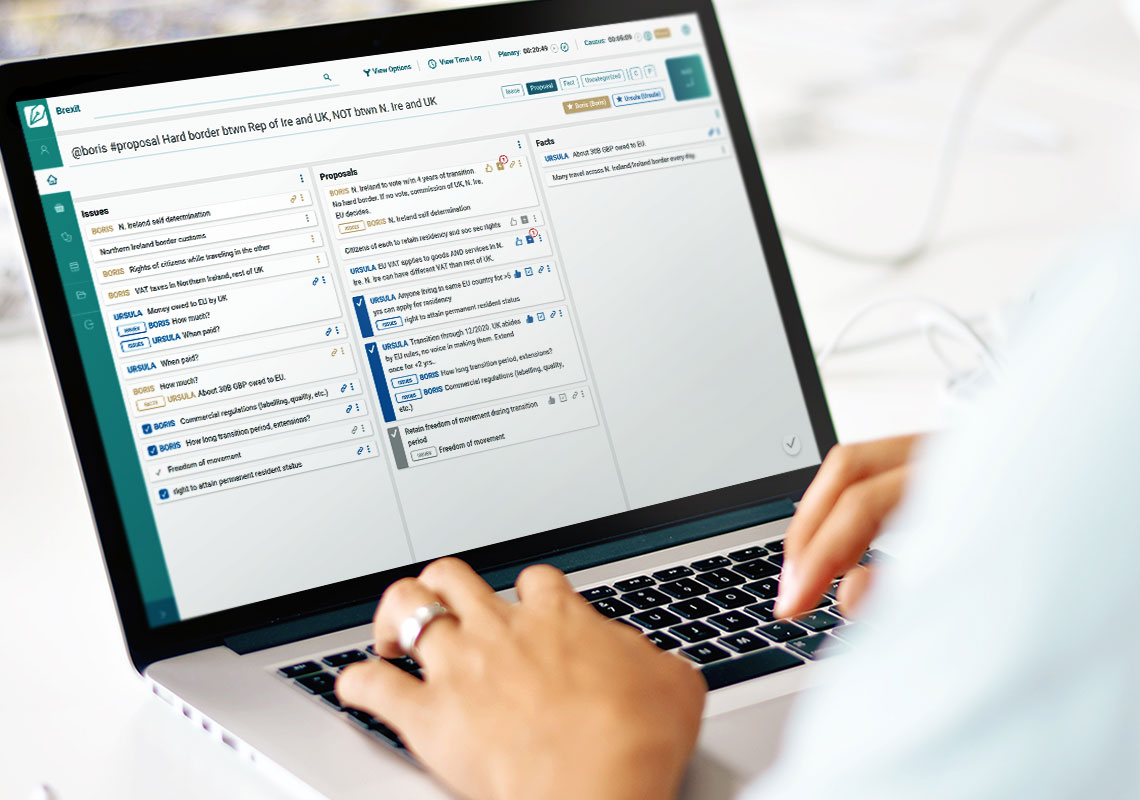

At ADR Notable, we are developing online tools to make mediators more efficient with a robust, online tool custom-made for dispute resolution. Learn more about its unique benefits and features.

Because this is a completely new tool, we want you to have plenty of time to experience how ADR Notable can make your life a little easier. That is why we are offering a full three-week free trial period. [No credit card required.]