3 Tips on how to Launch Your Mediation Practice

Now that you have completed your mediation training, retired as a judge, or decided to leave your law firm to embark upon operation of your own mediation practice, the time has come to answer the question: what should I do next? ADR Notable has some tips on how to launch your mediation practice.

So much to do and so little time…. where does each day go?

Deciding to start a business is stressful and a major responsibility. Your reputation and your personal assets are both at stake. As an attorney and certified public accountant (CPA) with two decades of combined experience, I have had many conversations with such individuals.

Acting as a counselor and an advocate, my practical advice focuses on concentrating on the following three areas:

- Legal

- Accounting

- Insurance

Legal Considerations

First, consult with a lawyer licensed in your jurisdiction to determine if forming a legal entity is in your best interest. This protects your personal assets and limits potential liability exposure. Often, forming a limited liability company provides the legal protection you desire with a lot of operational and tax flexibility.

However, there are always exceptions to every piece of advice and there certainly are other factors to consider. Additionally, beyond the limited liability company, there are other alternative legal entities to choose from.

Consult with the right lawyer and allow them to properly advise you.

Accounting Considerations

Second, consult with a CPA licensed in your jurisdiction about how you are legally structuring your mediation practice. Base this on your legal counsel consultation. In turn, this will often lead to a discussion with your CPA on what options you have regarding your tax obligations on the income you will earn.

Typical discussions with your CPA include opening a separate bank account to track your income and expenses, proper accounting approaches and expense deductions strategies, and choosing an accounting system that you manage or outsource to a trained bookkeeper.

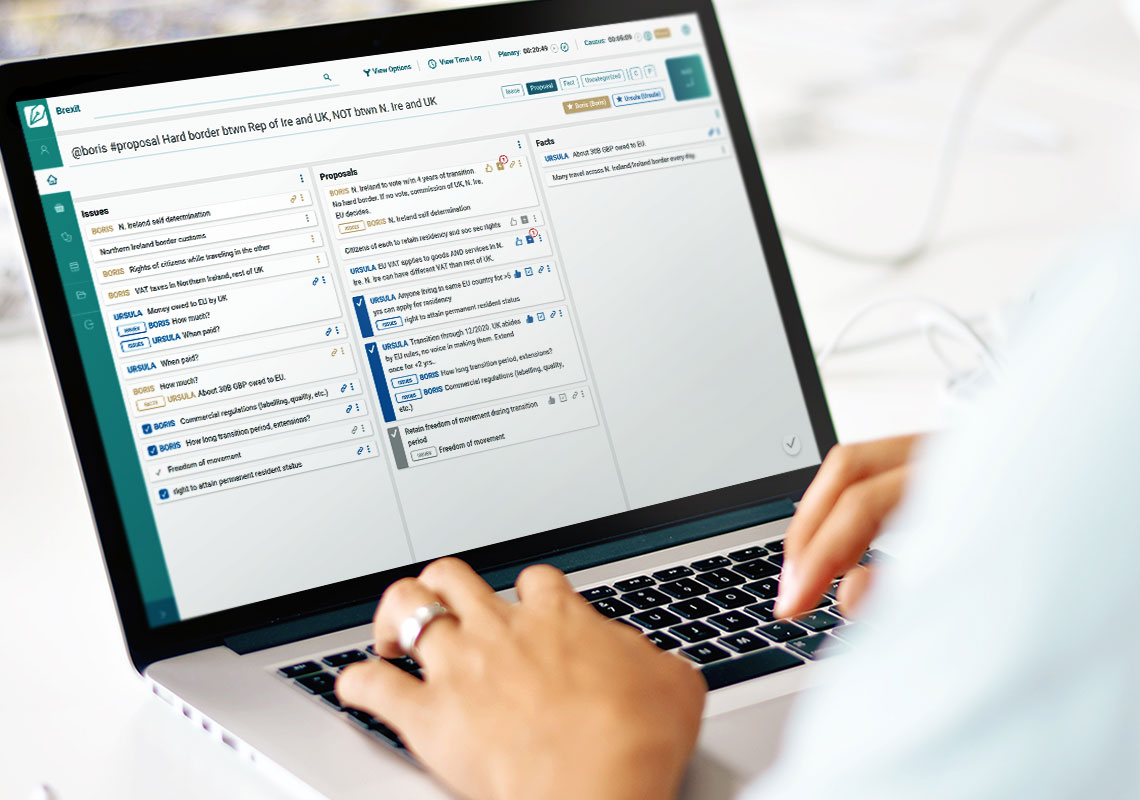

As part of this decision, you should also consider software options that will allow you to operate your business more efficiently and effectively. This is where ADR Notable can help. Specifically designed for a mediation practice, our case management platform assists you before, during, and after a session. Check out our 5 Minute Demo to see ADR Notable in action, and signup to receive 1-month free here.

Many mistakes have been made by individuals starting a business who ignore engaging a CPA early in the process. This results in hefty tax bills, IRS audits, and headaches that could have been avoided.

Insurance Considerations

Lastly, consult with an insurance broker licensed in your jurisdiction and talk to them about different types of coverage that may be applicable to you. Professional liability insurance is at top of the list, but other insurance types remain available. These may include general liability insurance, business owner’s policy insurance (BOP), cyber insurance, and worker’s compensation insurance. A good insurance professional should assist you in determining which policy types are in your best interest to mitigate your risk.

As the saying goes, “an ounce of prevention is worth a pound of cure.” Insurance is an area where people typically don’t like to spend their hard-earned money, but when needed and used, it is an asset – not a liability.

Take it Step-by-Step

In conclusion, legal, accounting, and insurance considerations are critical decision points to consider when launching your own mediation practice. This may feel overwhelming at first, especially if you have never owned and operated a business before. My best advice is to break down a big challenge into bite size pieces and consume them one by one until the entire challenge is conquered.

Best of luck and mediate away!!!

***DISCLAIMER*** This article is not intended to be construed as legal, accounting or tax advice.